The FOMC today communicated a “hawkish skip”, which was in-line with consensus, keeping the Fed Funds Rate unchanged at 5.25% - 5.50%. In doing so, they also provided more detail about their thinking about growth, the path of inflation, and their base case scenario for next year.

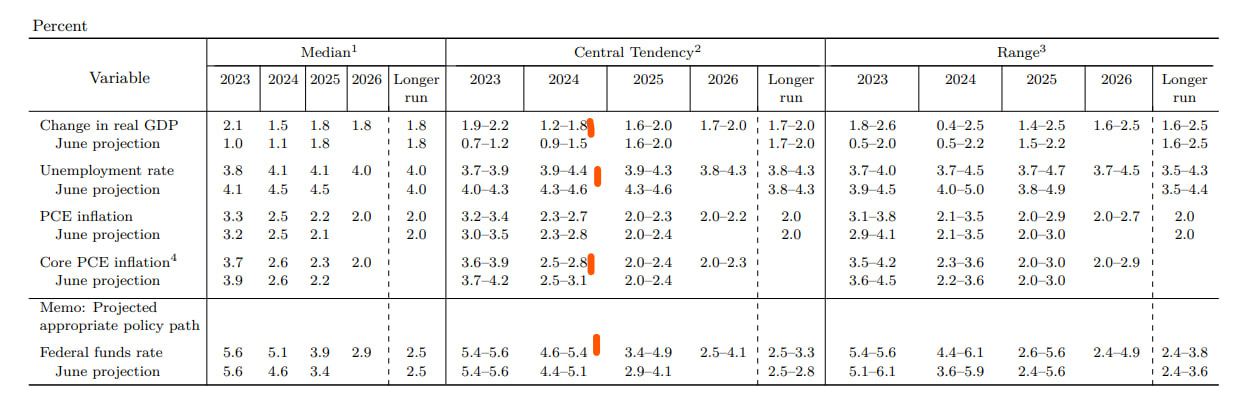

Dot Plot Higher

Comments:

Fed rose its GDP expectation for 2024; this has implications on where it thinks the natural interest rate is, and how durable they see the economy to weather higher interest rates.

The Fed’s view of the labor market widened but moved lower, hinting at greater uncertainty around the path of unemployment but also that they see the path of unemployment as more stable.

Core PCE forecasts from the Fed are quite lower, indicating they see the pace of disinflation to persist — ultimately, they expect inflation to be firmly within the 2% range by 2026. However, they also see greater upside risk to near-term inflation.

Market Reaction

Comments:

Treasuries sold off led by the short-end as the curve inversion deepened. I expect the belly to continue to sell-off as markets reprice “higher for longer” for longer.

Equity markets sold off though the S&P 500 is only ~4% lower from its July peak. I see today’s FOMC meeting as bearish for equities near-term, as markets digest the impact of higher interest rates through next year. The primary transmission will be through multiple contraction as Fed cuts in 2024 are pushed out further. Real risk revolves around cyclical industries that are interest-rate sensitive, such as housing, autos, and to some degree retailers.

The dollar rallied but is still below its early-September peak.

Longer-Term View

While today’s FOMC leaned hawkish, and I think equities and rates will sell off over the next few weeks, my risk view is that the Fed is already done raising interest rates and will need to cut early in 2024. There is potential that economic weakness will emerge over the next few months and challenge the narrative from the Fed.

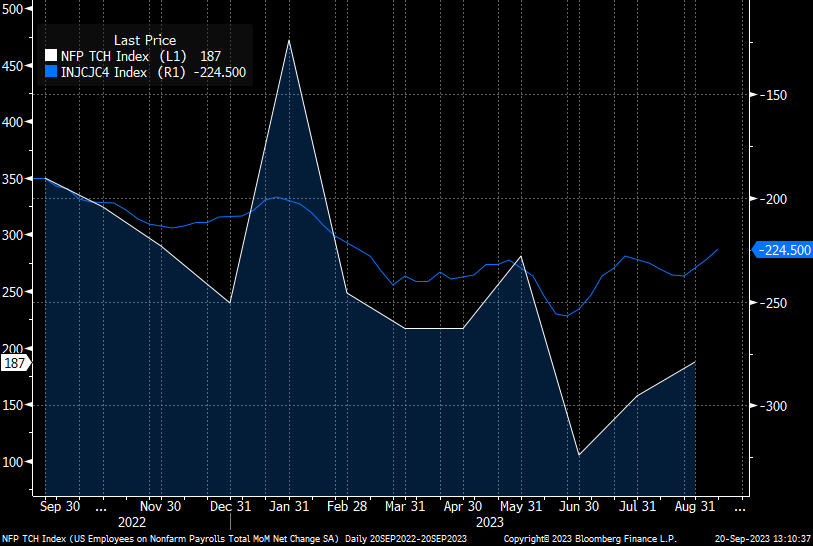

Unemployment is likely to move higher on the back of a government shutdown, UAW strikes, and the overall cooling trend in labor markets. Although initial jobless claims have been improving, if strikes continue for another week they’ll begin to show up in the data which could surprise the market. I expect October’s NFP to surprise lower (released in November), with a potential for a negative print.

Although data out of China has shown a pickup in demand, the United States and Europe continue to struggle with new orders, and this is likely to persist as interest rates remain elevated. I expect a big risk to manager confidence as nominal and real GDP trend lower, given how unprepared markets and executives were for higher interest rates for longer.

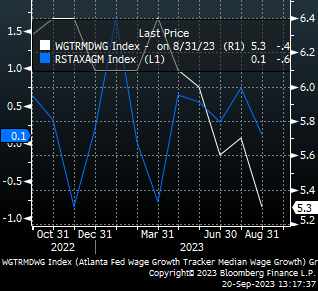

The services economy is likely to remain okay for as long as nonfarm payrolls remain positive. Previously, a sufficient margin of error existed in retail sales given higher bank account balances and wage growth. But with wage growth slowing, core retail sales ex-gas has shrunk enough, and I think will continue to struggle with higher energy prices (which act as a tax on consumption).

My view is that a recession (negative GDP print and rising unemployment) is likely by the end of the year.

If you have any questions, comments, or feedback, please feel free to contact me directly.

Best regards,

Muhammad Wahdy

Portfolio Manager

Wahdy Capital